Small Business Relief under UAE Corporate Tax Law gives resident businesses with revenue up to AED 3 million a tax break. Firms elect this option to count as having zero taxable income, avoiding the 9% tax rate. This temporary program runs until December 31, 2026.

Features of Small Business Relief

The UAE government created Small Business Relief to help smaller firms handle the new corporate tax system. Businesses qualify if they meet strict rules set by the Federal Tax Authority (FTA). This relief treats your firm as earning no taxable income during a tax period, which means no corporate tax bill.

Lawmakers passed Federal Decree-Law No. 47 of 2022 to launch UAE corporate tax at 9% on profits over AED 375,000. Yet, Small Business Relief steps in for those below the revenue threshold. You gain breathing room to grow without immediate tax hits.

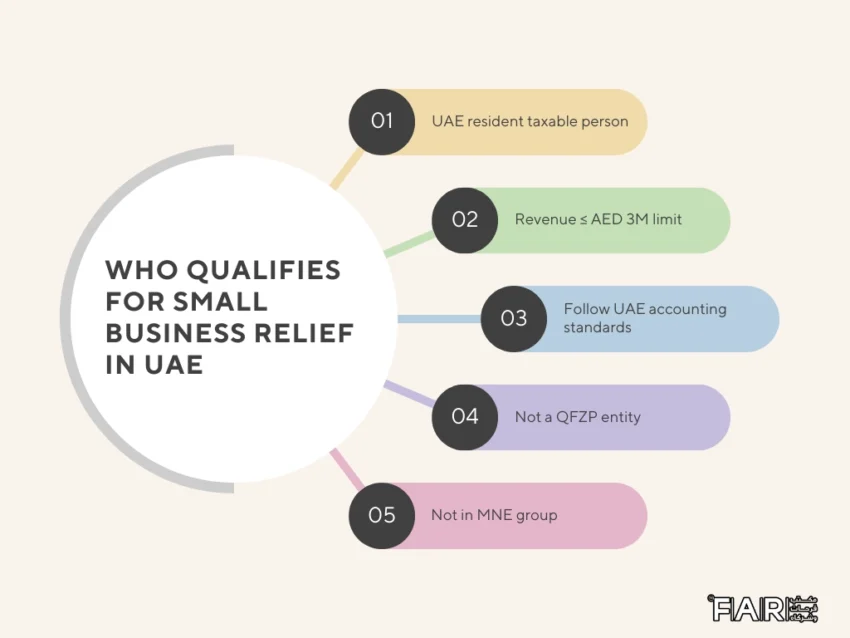

Who Qualifies for This Relief?

Your business must fit these core requirements to claim Small Business Relief:

- Act as a resident taxable person. This covers juridical persons like companies formed in the UAE or managed there, and natural persons running a business or business activity in the country.

- Keep revenue at or below AED 3,000,000 in the current tax period and every prior one. Count revenue using accepted UAE accounting standards, like IFRS.

- Avoid status as a Qualifying Free Zone Person (QFZP), which already gets 0% tax on certain income, or part of a Multinational Enterprise Group (MNE Group) with global revenue over AED 3.15 billion.

Freelancers qualify as natural persons if they hold a freelance permit and earn business income. Startups in mainland zones often fit too, but Free Zone firms claiming QFZP perks do not. If your firm joins a tax group, the group checks the threshold as one unit.

The program applies to tax periods starting June 1, 2023, or later, and ending by December 31, 2026. Exceed the limit once, and you lose eligibility forever in this window.

Benefits You Gain

Firms elect Small Business Relief to cut costs and simplify operations. You pay zero corporate tax, freeing cash for investments or daily needs. Compliance eases up, so no need to figure taxable income adjustments or follow transfer pricing rules.

You skip limits on interest deductions while under relief, but cannot carry forward losses or unused interest to future years. This suits profitable small firms without big debts. For example, a Dubai-based consultant earning AED 2.5 million yearly saves about AED 202,500 in tax (9% on profits above AED 375,000, assuming 100% profit margin).

Unlike Free Zone 0% rates, which demand substance tests like local staff and spending, Small Business Relief requires less proof. It fills a gap for mainland businesses not in zones.

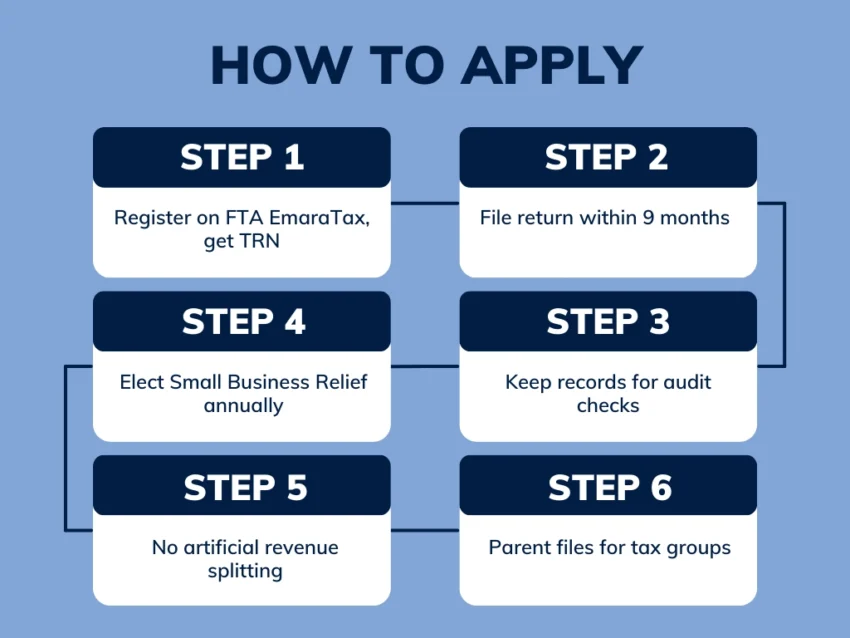

How to Apply and Comply

- Register your business for corporate tax on the FTA's EmaraTax portal first. Get a Tax Registration Number (TRN).

- File a corporate tax return within nine months after your tax period ends. Elect Small Business Relief right in the return, so no separate form needed. Do this each year you qualify.

- Keep records like financial statements and revenue proofs for audits. The FTA checks for artificial splits, where owners divide one business to stay under AED 3 million. Penalties apply if caught.

- For tax groups, the parent files for the whole group. If a qualifying firm joins a group over the threshold, it loses standalone relief.

Potential Drawbacks and When to Skip It

Electing relief blocks you from carrying forward tax losses or net interest expenses. If your business runs losses now but expects profits later, skip the election to use those losses against future taxes.

Free Zone firms should stick with QFZP status if they meet substance rules, as it offers ongoing 0% on qualifying income beyond 2026. Mainland firms with high interest costs might prefer standard rules to deduct expenses.

As of 2025, no changes hit the program, but watch FTA updates for any tweaks.

Small Business Relief Examples

- A freelance graphic designer in Abu Dhabi earns AED 2.8 million in 2025. She elects relief, files her return, and owes no tax. She reinvests savings in new tools.

- A small trading company in Sharjah, a juridical person, hits AED 3.2 million in 2024. It pays tax that year and cannot claim relief in 2025 or 2026.

- A group of three related firms forms a tax group with combined revenue of AED 2.9 million. The group elects relief successfully.

These cases show how relief aids growth while rules prevent abuse.

FAQs About Small Business Relief in the UAE

What revenue counts toward the AED 3 million threshold?

Include all business income per UAE accounting standards. Exclude exempt items like dividends if they fit other rules.

Can natural persons like freelancers claim this relief?

Yes, if they conduct a business activity and meet the revenue limit. Register and file as required.

What happens if I exceed the threshold mid-year?

You become ineligible from that tax period. Pay tax on income over AED 375,000 at 9%.

Do I need an audit for Small Business Relief?

No mandatory audit, but keep records. FTA may request them during reviews.

How does this differ from Free Zone tax perks?

Free Zones offer 0% on qualifying income indefinitely if conditions met. Relief is temporary and simpler for non-zone firms.

Mostafa is a seasoned Tax Consultant with over 5 years years of experience gained in diverse taxations matters. He has vast expertise in settling tax disputes with the Federal Tax Authority and handling of tax procedures in compliance with tax laws. He is adept in investigating underlying tax intricacies and offering expert tax advisory. He is also well-versed in conducting tax analysis’s and negotiations with the Tax Regulators, upon tax preparation and filing. Mostafa specializes in the areas of Tax law, Auditing, Accounting and Banking law.