Free Zone companies in the UAE face corporate tax obligations just like mainland businesses, but they can access a 0% tax rate if they meet specific conditions as Qualifying Free Zone Persons (QFZPs). The days of automatic tax exemption ended when the UAE Corporate Tax Law took effect on June 1, 2023.

The Reality Behind Free Zone Tax Benefits

While free zone companies can enjoy the benefits of corporate tax in UAE, they must follow some specific rules. Not following the rules won't make Free Zone companies exempted from corporate tax in UAE. Here are the rules:

All Free Zone Companies Must Register

Every Free Zone entity must register for corporate tax with the Federal Tax Authority (FTA), regardless of whether they qualify for the 0% rate. Registration happens through the EmaraTax online portal within 30 days of starting business activities. Many business owners still believe holding a Free Zone license grants automatic tax exemption. That's false. The corporate tax law applies to all UAE businesses, including those in designated Free Zones.

Two-Tier Tax Structure for Free Zones

Free Zone companies face one of two tax rates:

- 0% corporate tax on qualifying income for QFZPs

- 9% corporate tax on taxable income above AED 375,000 for non-qualifying entities

The rate depends entirely on meeting QFZP conditions, not just having a Free Zone license.

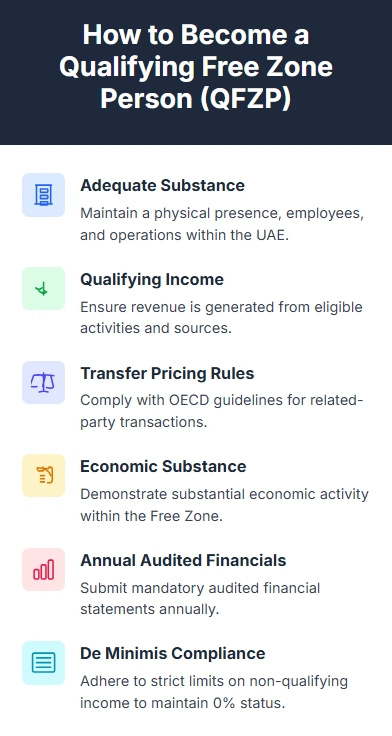

How to Become a Qualifying Free Zone Person (QFZP)

To qualify for 0% corporate tax, Free Zone companies must satisfy six cumulative conditions:

- Adequate substance in the UAE: Physical presence including office space, employees, and operational activities within the Free Zone

- Qualifying income requirements: Revenue must come from eligible activities

- Compliance with transfer pricing rules: Following OECD guidelines for cross-border transactions

- Economic substance regulations: Demonstrating substantial economic activity within the Free Zone

- Annual audited financials: Mandatory submission requirement

- De minimis threshold compliance: Non-qualifying income limits

Missing any single condition disqualifies the entire entity from the 0% rate.

What Counts as Qualifying Income

Qualifying income includes revenue from:

- High-sea sales (goods sold while in transit)

- Direct exports outside the UAE

- Transactions between Free Zone entities

- Sales of goods that never enter mainland UAE

- Inter-Free Zone services

Non-Qualifying Income Examples

Income that does not qualify for 0% tax includes:

- Sales to mainland UAE customers

- Services provided to mainland businesses

- Investment interest and dividends

- Real estate rental income from mainland properties

The De Minimis Rule

According to the Ministry of Finance, Free Zone companies can earn limited non-qualifying income without losing their 0% status. The de minimis threshold allows non-qualifying revenue up to the lower of:

- 5% of total revenue, OR

- AED 5,000,000

Exceeding this threshold triggers the standard 9% tax rate on all income.

Five-Year Penalty Period

Companies that fail to meet QFZP conditions face a minimum five-year exclusion from the Free Zone tax regime. During this period, they pay 9% corporate tax as ordinary taxable persons.

Registration and Compliance Requirements

All Free Zone companies must meet these deadlines:

|

Requirement |

Deadline |

|

Corporate tax registration |

Within 30 days of starting operations |

| Annual tax return filing |

Within 9 months of financial year-end |

| Tax payment (if applicable) |

Within 9 months of financial year-end |

| Change notifications to FTA |

Within 20 business days of changes |

Required Documentation

Free Zone entities need these documents for tax compliance:

- Audited financial statements (now mandatory for all Free Zone companies)

- Detailed income segregation between qualifying and non-qualifying sources

- Transfer pricing documentation for related-party transactions

- Economic substance reports

- Board resolutions and corporate records

2025 Updates and Changes

Dubai issued Executive Council Resolution No. 11 of 2025 in March, allowing Free Zone companies to operate in mainland Dubai under specific conditions. This creates new tax considerations as mainland activities typically generate non-qualifying income. The UAE government announced a corporate tax review for 2025, which may include:

- Stricter conditions for qualifying Free Zone activities

- Enhanced documentation requirements for substance testing

- Lower transfer pricing thresholds for SMEs

- Stronger anti-abuse measures

In addition, the FTA has increased audit activities targeting Free Zone entities that claim 0% tax rates. Companies should prepare comprehensive documentation supporting their QFZP status claims.

Common Misconceptions That Cost Money

|

Dormant Companies Don't Need to Register |

Wrong. Even inactive Free Zone companies must register for corporate tax if they remain legally incorporated. Failure to register triggers penalties and interest charges. |

| Free Zone License Equals Tax Freedom |

The license alone provides no tax benefits. Only companies meeting all QFZP conditions access the 0% rate. |

| Small Income Amounts Don't Matter |

Any non-qualifying income counts toward the de minimis calculation. Even small mainland sales can push companies over the 5% threshold. |

Practical Steps for Compliance

- Register with FTA if not already done

- Segregate income streams between qualifying and non-qualifying sources

- Document economic substance with employee records, office leases, and operational evidence

- Prepare audited financials for the current year

- Review customer base to identify mainland UAE transactions

Given the complexity and penalty risks, most Free Zone companies benefit from professional tax advisory services. The cost of expert guidance typically pays for itself through proper structuring and compliance.

Final Words About Tax Exemption for UAE Free Zone Companies

The biggest mistake we see Free Zone companies make is treating the new corporate tax law like the old tax-free regime. The 0% rate isn't automatic; it is earned through strict compliance. Companies that fail to adapt their operations and record-keeping to meet QFZP conditions often face unexpected tax bills and penalties. Start preparing your documentation now, because the FTA's audit capabilities are expanding rapidly, and retroactive compliance corrections are expensive and time-consuming.

FAQs About Free Zone Tax Exemption

Do Free Zone companies automatically get 0% corporate tax in the UAE?

No, Free Zone companies must meet specific qualifying conditions to access the 0% rate. Without meeting these requirements, they pay 9% corporate tax on taxable income above AED 375,000.

What happens if my Free Zone company sells to mainland UAE customers?

Sales to mainland UAE customers generate non-qualifying income subject to 9% corporate tax. If non-qualifying income exceeds 5% of total revenue or AED 5 million, you lose the entire 0% benefit.

Must dormant Free Zone companies register for corporate tax?

Yes, all legally incorporated Free Zone entities must register for corporate tax, even if dormant or inactive. Failure to register results in penalties and interest charges.

How long does the penalty period last if I lose QFZP status?

Companies that fail to meet qualifying conditions face a minimum five-year exclusion from the Free Zone tax regime, during which they pay standard 9% corporate tax rates.

Can Free Zone companies operate in mainland UAE without tax consequences?

Recent Dubai regulations allow Free Zone companies to operate in mainland under specific conditions, but mainland activities typically generate non-qualifying income subject to higher tax rates.

What documentation proves adequate substance for QFZP status?

You need office lease agreements, employee contracts, operational records, board meeting minutes, and evidence of decision-making activities within the Free Zone to demonstrate adequate substance.

Abrar Ahmad holds a Master’s as well as an MPhil in Finance and has an extensive experience of 10+ years in managing all aspects of Taxation, VAT Consulting and Accounting. He also carries with him a working knowledge of corporate tax and has helped drive value and growth to the businesses of numerous clients.