Non-residents of Canada who earn income from Canadian sources must navigate not only the Income Tax Act (ITA) but also consider the potential impact of tax treaties between Canada and

In acknowledgment of the importance of communication with the business sector and other interested parties, the UAE Ministry of Finance announced on April 28, 2022, a public consultation on a

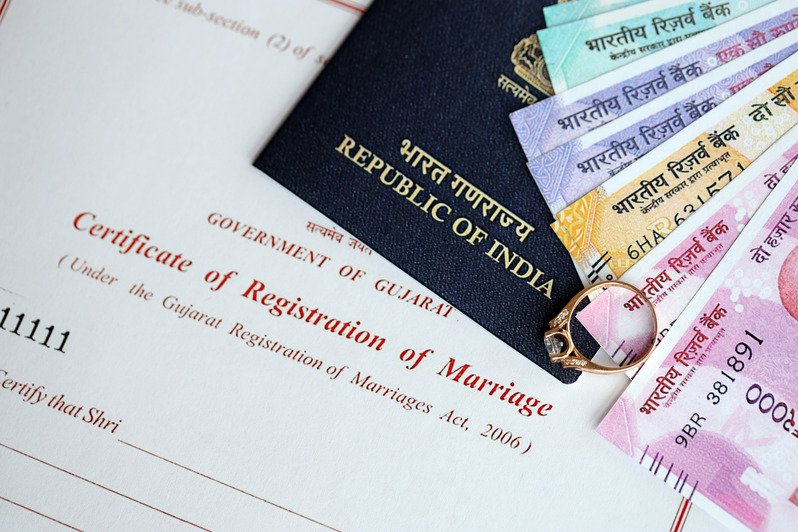

Residency taxes Dubai serves as a venue for the relief of double taxation burdens for people, companies, and foreign investors and commercial entities. A Dubai tax residency certificate can be

A tax assessment verifies the authenticity and completeness of the filed tax returns and calculates the total tax payable. The Federal Tax Authority enforces authority for Corporate Tax Law, including

Charities engage in various activities in the accomplishment of their charitable purposes. Such activities may include direct charitable services and trading activities such as sales of various items through shops.

Registration is the first step for any corporate entity in the UAE that is mandatory to take benefits by keeping accurate and thorough financial records for corporate tax compliance. These

The method of calculating corporate tax under UAE taxation law involves using the net profit that appears in the profit and loss of a company. Corporate tax return preparation and

A tax invoice can be defined as a written document that proves the occurrence of taxable supplies and their details. An original copy of this invoice is delivered by the

As per the proposed new UAE corporate tax law coming into effect from or after June 1, 2023, individuals and legal persons are subject to and exempt from corporate tax

Commencing from June 2023, UAE businesses are assumed to strap up for Corporate Tax adherence. Thus, it is essential for corporations that constitute the scope of the UAE Corporate Tax

The imposition of VAT and other taxes in the UAE increases the likelihood of tax disputes taking place between taxpayers and tax authorities. As the economic growth rate increases in

For the implementation of guidelines set by the OECD (Organization for Economic Cooperation and Development) which is a component of BEPS (base aeration and profit shifting) for the CBCR (Country