Corporate Tax Group Formation

For two or more companies to be treated as one for corporate tax purposes, tax group formation is necessary. Instead of having to submit multiple tax returns, one parent company in the group may submit a consolidated tax return.The consolidated structure saves time and costs, and it allows for a more complete view of the finances of the entire group.

UAE Corporate Tax Group Formation Eligibility

Not all business structures may be eligible to form a tax group, and the FTA has specific standards to which companies should comply before completing a tax group formation application.

Ownership – The parent company must own at least 95% of the share capital, voting rights, and profits of each subsidiary.

Residency – All members must be UAE resident companies.

Same financial year – All companies in the group must follow the same reporting year.

Legal status – Certain exempt entities or companies benefiting from specific free zone regimes may not be allowed to join.

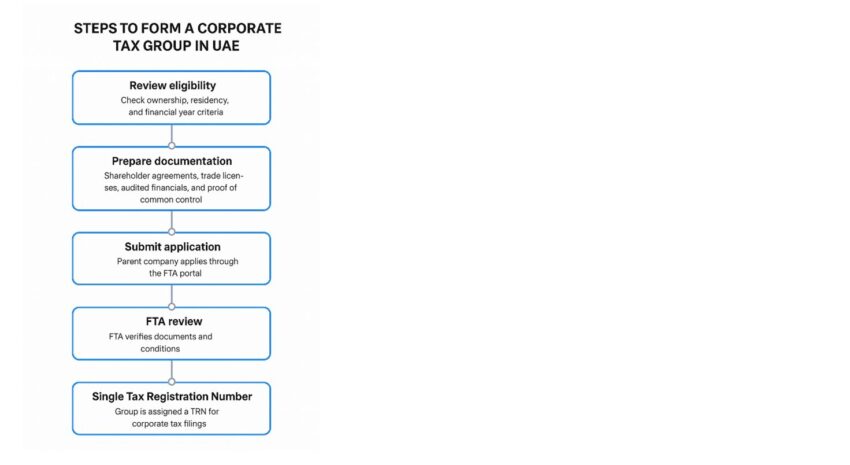

How Does the Group Registration Process Work?

To find a clear picture of the corporate tax group registration process in the UAE,including:

Understanding the rules related to forming corporate groups in the UAE can be complex, and the potential mistakes can be very costly, which is why getting specialists in this area is very important.

How Top Corporate Tax Consultants in the UAE Can Assist

To seamlessly form a corporate tax group in compliance with corporate tax regulations in the UAE, businesses should seek the expert services of top Tax Consultants in the UAE. Contact us today, and we shall be glad to assist you.

Frequently Asked Questions (FAQs)