M&A Due Diligence in the UAE

What is M&A Due Diligence

M&A due diligence is a deep investigation of a target company. This review occurs before finalizing an acquisition or merger. It verifies a seller's claims and uncovers potential risks or hidden liabilities. The primary goal is to confirm the deal's true value. Buyers get a complete and accurate picture of the business. Thus, this process empowers you to negotiate better terms.

Why Due Diligence is Important in the UAE

Conducting thorough due diligence is vital in the UAE's dynamic market. It helps buyers confirm a target's financial health and operational stability. The process reveals liabilities or compliance gaps specific to the region. It ensures the acquisition aligns with your strategic and financial goals. Proper review protects your investment from unforeseen problems.

The 4 Ps of M&A Due Diligence

According to a research study published by Springer, a simple way to frame the investigation is through the "4 P's." This model helps ensure all critical areas are covered.

-

People

This involves reviewing the management team, key employees, and overall company culture. You assess the skills and stability of the workforce. In the UAE, this includes checking visa statuses and employment contracts. The goal is to ensure the human capital you are acquiring is sound.

-

Property

Property includes all physical and intellectual assets. You must verify the ownership and condition of real estate, equipment, and inventory. It also covers trademarks, patents, and copyrights. A clear title to all assets is crucial.

-

Process

Process refers to the company's operational workflows. This includes its supply chain, sales pipeline, and IT systems. You analyze how the business creates and delivers its products or services. This helps identify inefficiencies or opportunities for synergy.

-

Performance

Performance is the financial health of the business. You analyze historical financial statements, profit margins, and cash flow. The objective is to validate the company's profitability. You also assess the reasonableness of future projections.

Important Types of Due Diligence

A successful review examines a company from multiple angles. Each type focuses on a specific area of the business.

Financial Due Diligence UAE

Financial due diligence UAE is a core part of the overall M&A process. It is not a separate activity but an integral component. This review involves a deep dive into all financial records. You will analyze audited statements, revenue streams, and debt schedules. The goal is to confirm the company's profitability and financial stability.

Legal Due Diligence UAE

Legal due diligence UAE is crucial for risk management. It inspects corporate documents, contracts, permits, and licenses. This process identifies litigation risks and regulatory compliance issues. It verifies the ownership of assets and intellectual property. This review is vital for understanding specific UAE M&A regulations.

Operational Due Diligence

This review assesses how the business actually runs day-to-day. It examines production processes, supply chains, and key IT infrastructure. The goal is to find operational strengths, weaknesses, and potential risks. It helps plan for a smooth integration after the deal closes.

Commercial Due Diligence

Commercial review examines the target's position in the market. It analyzes the customer base, competitors, and industry trends. This helps validate the business model and its growth forecasts. You gain a better sense of the company's commercial viability.

Human Resources (HR) Due Diligence

HR diligence inspects the company's workforce and related liabilities. It covers employment contracts, compensation structures, and company culture. In the UAE, this must include checking visa statuses and end-of-service gratuity obligations.

The Merger and Acquisition Process UAE: A Step-by-Step Framework

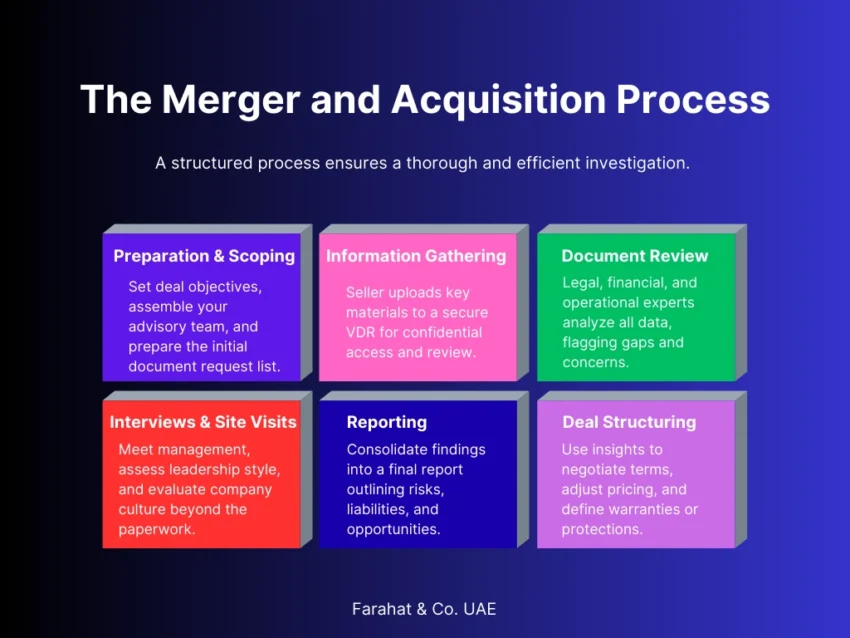

A structured process ensures a thorough and efficient investigation. The flow typically moves from high-level review to detailed analysis.

- Preparation & Scoping: Define objectives and assemble your advisory team. An initial request list for key documents is created.

- Information Gathering: The seller populates a secure virtual data room (VDR). Your team gains access to review materials confidentially.

- Document Review: Your legal, financial, and operational teams analyze all provided information. They identify gaps and areas needing clarification.

- Interviews & Site Visits: Meet with the target's key management. This provides context that documents cannot. It helps assess leadership and culture.

- Reporting: All findings are consolidated into a final due diligence report. This report highlights key risks, liabilities, and opportunities.

- Deal Structuring: The findings inform final negotiations. The price may be adjusted, or specific warranties may be added to the agreement.

UAE M&A Regulations & Jurisdictions

Operating in the UAE requires a focus on local laws and business practices.

-

- Company Structure: You must verify the target’s legal structure. Is it a mainland LLC or a Free Zone entity? Each jurisdiction has different ownership rules.

- Trade Licenses: Ensure all trade licenses are valid and current. Check that listed business activities match actual operations to avoid fines.

- Employment Law: Calculate the total accrued end-of-service gratuity. This is a significant liability you will inherit. Audit all employee visas and labor contracts.

- Tax Compliance: Review the company’s VAT registration and filing history. Assess its readiness and potential liabilities under the UAE Corporate Tax law.

Mainland vs. Free Zone Due Diligence Requirements

The location of the target company significantly impacts the diligence focus.

| Area of Focus | Mainland Company (LLC) | Free Zone Company (FZE/FZCO) |

|---|---|---|

| Ownership | Governed by UAE Commercial Companies Law. May involve local partners. | Governed by specific Free Zone Authority rules. Often allows 100% foreign ownership. |

| Regulator | Department of Economic Development (DED) and other federal bodies. | The specific Free Zone Authority (e.g., DIFC, ADGM). |

| Licenses | Requires DED trade license and possibly other ministry approvals. | Requires a license issued by its specific Free Zone. Activities are often restricted to the zone. |

| Employee Visas | Visas processed through MoHRE and GDRFA. | Visas processed through the respective Free Zone Authority. |

The Complete UAE Company Acquisition Checklist

An M&A due diligence checklist is a structured document. It lists all information a buyer needs to review. Using a detailed template like this ensures a systematic investigation.

Financial Checklist

- Audited financial statements for the past 3–5 years.

- Future financial projections and budgets.

- Detailed schedule of all debts and liabilities.

- VAT and Corporate Tax filings and correspondence with the FTA.

- Accounts receivable and payable aging reports.

Legal & Corporate Checklist

- Valid trade licenses for all Emirates of operation.

- Memorandum and Articles of Association.

- Minutes of board and shareholder meetings.

- Details of any current, pending, or threatened litigation.

- Schedule of registered trademarks, patents, and copyrights.

HR & Employee Checklist

- List of all employees with job titles, salaries, and start dates.

- Copies of all employment contracts and the employee handbook.

- Calculation of accrued end-of-service gratuity for all staff.

- Confirmation of valid visa and labor card status for all employees.

- Records of any past or present labor disputes.

Operational & IT Checklist

- List of key suppliers and copies of major contracts.

- List of top customers and analysis of revenue concentration.

- Property lease agreements for all offices and facilities.

- Overview of IT systems, software licenses, and cybersecurity policies.

- Inventory reports and valuation methods.

FAQs About M&A Due Diligence in the UAE

How long does due diligence take at M&A?

The due diligence timeline typically ranges from 30 to 90 days. The exact duration depends on the target's size, the seller's preparation, and the overall scope of the investigation.

What is the key UAE M&A regulations to consider?

Key UAE M&A regulations include the UAE Commercial Companies Law, competition laws, and rules set by specific regulators like the SCA or Free Zone authorities. Compliance is mandatory.

What is the most common red flag found?

Incomplete or poorly organized records are a major red flag. It can suggest deeper operational or compliance problems. Unclear related-party transactions also require careful scrutiny during the review.

Secure Your Next Acquisition

A thorough due diligence process is the foundation of a successful M&A deal. Our expert advisory team helps you navigate the complexities of the UAE market.