UAE Corporate Tax Penalty Resolution

The Financial Impact of Tax Penalties

The FTA enforces strict penalties for non-compliance with Federal Decree-Law No. 47 of 2022. Each violation has a specific monetary consequence. Understanding these figures shows the importance of correct and timely tax conduct.

| Penalty Type | Violation | Amount (AED) | Official Reference |

|---|---|---|---|

| Late Registration | Failure to submit a Corporate Tax registration application within the FTA's specified timeframe. Learn more about our Corporate Tax Registration services | 10,000 | Cabinet Decision No. 75 of 2023 |

| Late Filing | Failure to file the Corporate Tax return by the due date. | 500 per month (up to 12 months) | Cabinet Decision No. 75 of 2023 |

| Late Payment | Failure to pay the Corporate Tax due by the deadline. | 14% per year on the unpaid amount | Cabinet Decision No. 75 of 2023 |

| Incorrect Return | Submitting a tax return with errors that result in an incorrect tax calculation. | 500 + % of the unpaid tax | Cabinet Decision No. 75 of 2023 |

Our Corporate Tax Penalty Services

We provide specific, targeted services to manage and mitigate tax penalties. Our approach is direct and based on extensive experience with FTA procedures.

Penalty Assessment and Root Cause Analysis

Before we act, we determine the exact cause of the penalty. Was it a simple oversight, a misinterpretation of the law, or a systemic bookkeeping issue? We review your tax records, past filings, and correspondence with the FTA to identify the core problem. Thus, this prevents the same penalty from occurring again.

FTA Penalty Reconsideration Request Filing

If you believe a penalty was applied in error, you have the right to challenge it. We prepare and submit a formal Reconsideration Request to FTA on your behalf. We build a strong case supported by factual evidence, legal arguments, and procedural records to argue for the penalty removal.

Voluntary Disclosure Assistance in the UAE

Discovering an error in a previously filed tax return requires immediate action to reduce penalties. We help you prepare and submit a Voluntary Disclosure. Remember, this formal submission corrects the error and demonstrates good faith to the FTA, which can significantly reduce the associated penalties for the incorrect filing.

Case Example: Resolving a Late Filing Penalty

A Dubai-based trading company with an annual revenue of AED 5 million missed its first corporate tax return deadline. The business owner was unaware of the specific filing date for their trade license.

Initial Penalty

The FTA issued a notice for an AED 1,000 penalty (AED 500 for each of the two months that had passed). A late payment penalty was also accruing on their calculated tax liability of AED 30,000. The business owner was unaware of the specific filing date for their trade license.

Our Action

We were engaged to handle the situation. We immediately compiled the necessary financial statements and filed the overdue tax return. Concurrently, we prepared a Reconsideration Request. Our argument was based on the fact that the company was a new taxable person and there was genuine confusion about the initial filing period, supported by evidence of their otherwise compliant history.

Result

The FTA accepted the Reconsideration Request and waived the AED 1,000 late filing penalty. The company only had to pay the principal tax amount and the small, unavoidable late payment interest. We also set up a compliance calendar for them to prevent future issues.

Why Work with Us?

- Direct FTA Experience: We have direct, practical experience managing cases with the Federal Tax Authority. We know the procedures, documentation requirements, and common pitfalls.

- Clear Communication: You receive straightforward updates without confusing jargon. We explain the problem, our plan, and the results.

- Focus on Long-Term Corporate Tax Compliance in the UAE: Our work is not finished once a penalty is resolved. We show you the changes needed in your accounting and reporting processes to maintain compliance.

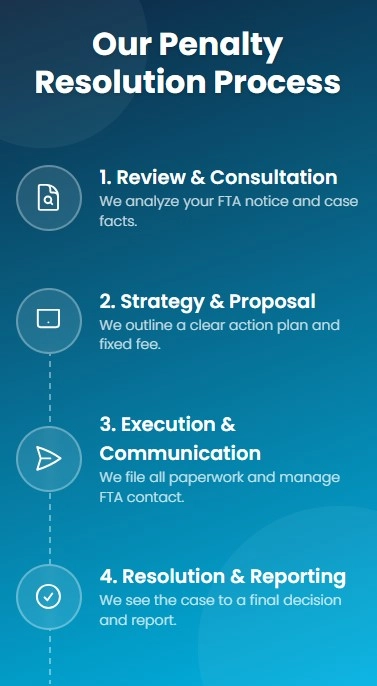

Our Corporate Tax Penalty Resolution Process

- Initial Consultation & Document Review: You provide us with the FTA notice and relevant financial documents. We hold a meeting to discuss the facts of your case.

- Strategy and Proposal: We outline a clear plan of action, whether it's filing a reconsideration, a voluntary disclosure, or another course. You receive a fixed-fee proposal.

- Execution and FTA Communication: We execute the plan. This includes preparing all paperwork, submitting it to the FTA via the EmaraTax portal, and handling all follow-up communication.

- Case Resolution and Final Reporting: We see the case through to a final decision from the FTA. We provide you with a full report on the outcome and advise on next steps for your business.

FAQs About Resolving UAE Corporate Tax Penalties

Can a corporate tax penalty be reduced or waived?

Yes. Through the formal Reconsideration Request process, a penalty can be waived if you can provide sufficient evidence that the violation was not intentional or occurred due to a legitimate reason. A reduction is also possible through mechanisms like Voluntary Disclosure.

What is the first thing I should do if I get a penalty notice?

Do not ignore it. The first step is to read the notice carefully to know the reason for the penalty and the deadline for payment or appeal. Then, contact a qualified tax professional to assess your options before the deadline expires.

How long does the FTA take to review a Reconsideration Request?

The FTA typically takes around 40 business days to review a submitted request and issue its decision. We monitor the status of the application and respond to any inquiries from the authority during this period.

Stop Worrying About Penalties. Secure Your Compliance Today

Tax penalties are manageable when addressed with speed and expertise.