A natural person in UAE Corporate Tax refers to any living individual who conducts business activities in the UAE and earns over AED 1 million annually. Under Federal Decree-Law No. 47 of 2022, these individuals must register for corporate tax and pay rates of 0% on income up to AED 375,000 and 9% on income exceeding this threshold.

Natural Person Under UAE Corporate Tax Law

The UAE's Federal Tax Authority (FTA) defines a natural person as any living human being, regardless of age or legal capacity. The definition includes minors and incapacitated individuals who are represented by legal guardians or representatives.

The corporate tax framework treats natural persons differently from juridical entities, applying specific criteria to determine tax liability. The law recognizes that individuals conducting business activities contribute significantly to the UAE's economy and should participate in the tax system accordingly.

Legal Foundation and Authority

Federal Decree-Law No. 47 of 2022 serves as the primary legislation governing corporate tax for natural persons. The law became effective from June 1, 2023, with the first tax period for natural persons beginning from the 2024 Gregorian calendar year.

The FTA has issued detailed guidance through the "Corporate Tax Guide: Taxation of Natural Persons under the Corporate Tax Law" to help individuals understand their obligations.

Tax Liability Criteria for Natural Persons

Natural persons become subject to corporate tax only when their total turnover exceeds AED 1 million within a Gregorian calendar year (January to December). The threshold applies specifically to income derived from business or business activities conducted in the UAE. The AED 1 million threshold calculation includes:

- Revenue from sole establishments

- Income from individual partnerships in unincorporated entities

- Business activity income generated within UAE jurisdiction

Business Activity Requirements

To trigger corporate tax liability, natural persons must meet two fundamental conditions:

- Conduct business or business activities in the UAE

- Generate total turnover exceeding AED 1 million annually

The law requires both conditions to be satisfied simultaneously. Simply earning over AED 1 million from non-business sources does not create tax liability.

Excluded Income Categories

The corporate tax law specifically excludes certain income types from the turnover calculation:

- Employment wages under formal employment contracts

- Personal investment income including dividends, capital gains, and interest from savings accounts

- Real estate investment income not conducted through business licenses

These exclusions ensure that only genuine business activities fall under corporate tax obligations.

Corporate Tax Rates and Calculations

Natural persons subject to corporate tax face a two-tier rate structure:

|

Taxable Income Range |

Tax Rate | Example Calculation |

| AED 0 to 375,000 | 0% |

AED 300,000 income = AED 0 tax |

| Above AED 375,000 | 9% |

AED 500,000 income = AED 11,250 tax |

Tax Calculation Example

For a natural person earning AED 600,000 in taxable business income:

- First AED 375,000: AED 0 tax (0% rate)

- Remaining AED 225,000: AED 20,250 tax (9% rate)

- Total tax liability: AED 20,250

So, this progressive structure provides relief for smaller businesses while ensuring larger operations contribute proportionally.

Registration Requirements and Deadlines

Natural persons who exceeded the AED 1 million threshold during 2024 must register for corporate tax no later than March 31, 2025. The FTA has emphasized this deadline repeatedly, warning of administrative penalties for late registration.

Registration Process Steps

The registration process involves several steps:

- Access the EmaraTax platform

- Create a user profile with email ID and phone number

- Complete the Corporate Tax registration application

- Submit required documentation

- Receive Tax Registration Number upon approval

Existing VAT or Excise Tax registrants can use their current EmaraTax accounts to add Corporate Tax registration.

Late Registration Penalties

The FTA imposes an AED 10,000 administrative penalty for natural persons who fail to register by the applicable deadline. Remember, this penalty applies regardless of actual tax liability, making timely registration crucial.

Compliance Obligations and Filing Requirements

Natural persons must file tax returns within 9 months following the end of their tax period. For the 2024 tax year, this means filing by September 30, 2025.

The tax period for natural persons follows the Gregorian calendar year, running from January 1 to December 31. The standardized approach simplifies compliance compared to varied financial year structures used by companies.

Natural persons must maintain proper business records to support their tax calculations, including:

- Revenue documentation

- Business expense records

- Related party transaction details

- Supporting documentation for deductions

Small Business Relief Eligibility

Natural persons may elect for Small Business Relief under Article 21 of the Corporate Tax Law. The relief allows qualifying taxpayers to treat their taxable income as zero, effectively eliminating corporate tax liability. To qualify for Small Business Relief, natural persons must meet these conditions:

- Annual revenue not exceeding AED 3 million in both current and preceding tax periods

- Resident person status in the UAE

- Not engaged in tax shelter or syndicate activities

Relief Benefits and Limitations

Small Business Relief provides significant advantages:

- Zero corporate tax liability during the relief period

- Simplified cash-based accounting instead of accrual methods

- Reduced compliance burden for qualifying businesses

However, important limitations apply:

- No tax loss accumulation during the relief period

- Cannot transfer tax losses to other entities

- Must requalify annually based on revenue thresholds

Residency Status and Tax Implications

Resident natural persons face corporate tax on worldwide business income derived from UAE business activities. Cabinet Decision No. 49 of 2023 clarifies that residency status affects the scope of taxable income but does not change the AED 1 million threshold requirement. On the other hand, non-resident natural persons are subject to corporate tax on:

- Income attributable to permanent establishments in the UAE

- UAE-sourced business income not attributable to permanent establishments

- Income attributable to nexus activities as specified in Cabinet decisions

Deregistration Requirements

Natural persons must deregister for corporate tax within 3 months of specific events:

- Cessation of business activities in the UAE

- Death of the natural person

- Permanent departure from UAE business activities

The deregistration application must be filed through the EmaraTax platform, similar to the registration process. Failure to deregister timely may result in continued compliance obligations and potential penalties.

Common Compliance Challenges and Risks

Many natural persons struggle with accurately calculating the AED 1 million threshold, particularly when multiple income streams exist. Professional guidance becomes essential for individuals with:

- Mixed business and investment income

- Cross-border business activities

- Partnership interests in multiple entities

Natural persons conducting business with related entities must ensure arm's length pricing for tax purposes. So, this requirement is usually complex for family businesses or interconnected ventures.

Maintaining adequate documentation to support tax positions presents ongoing challenges. Natural persons must establish robust record-keeping systems to satisfy FTA requirements during potential audits.

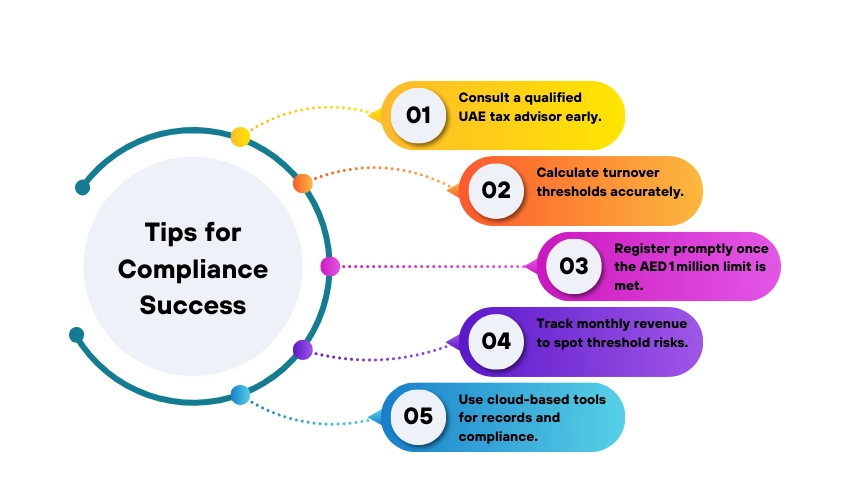

Practical Tips for Compliance Success

Given the complexity of corporate tax regulations, natural persons should engage qualified tax advisors early in the process. Professional guidance helps with:

- Accurate threshold calculations

- Proper registration procedures

- Ongoing compliance monitoring

- Tax planning opportunities

Natural persons should implement monthly revenue tracking systems to identify potential threshold breaches early. Remember, this proactive approach allows for proper tax planning and timely registration.

Establishing digital record-keeping systems from the outset simplifies compliance and audit preparation. Cloud-based accounting software can automate much of the documentation process.

Final Words About Natural Person in UAE Corporate Tax

Based on years of advising UAE businesses through major tax transitions, I have observed that natural persons often underestimate the administrative burden of corporate tax compliance. The AED 1 million threshold might seem straightforward, but mixed income streams and partnership interests create complexity that demands professional attention.

Starting preparation now, rather than waiting, prevents costly mistakes and ensures smooth compliance with this fundamental shift in UAE's tax landscape. Consult a professional tax advisor for natural person corporate tax now

FAQs About Natural Persons in Corporate Tax UAE

Who qualifies as a natural person under UAE Corporate Tax?

Any living human being of any age, including minors represented by legal guardians, who conducts business activities in the UAE with annual turnover exceeding AED 1 million qualifies as a natural person subject to corporate tax.

What income is excluded from the AED 1 million threshold calculation?

Employment wages, personal investment income (dividends, capital gains, interest), and real estate investment income not conducted through business licenses are excluded from turnover calculations for determining corporate tax liability.

Can natural persons apply for Small Business Relief?

Yes, natural persons with annual revenue not exceeding AED 3 million in current and preceding tax periods can elect for Small Business Relief, which eliminates corporate tax liability and allows simplified accounting methods.

What happens if a natural person fails to register by March 31, 2025?

The FTA imposes an AED 10,000 administrative penalty for late registration. Natural persons who exceeded AED 1 million turnover in 2024 must register by this deadline to avoid penalties.

How are tax rates calculated for natural persons?

Natural persons pay 0% corporate tax on taxable income up to AED 375,000 and 9% on taxable income exceeding AED 375,000. The rates apply progressively, not as flat rates on total income.

When must natural persons file their tax returns?

Tax returns must be filed within 9 months after the end of the tax period. For 2024 (the first tax year), returns are due by September 30, 2025.

Mostafa is a seasoned Tax Consultant with over 5 years years of experience gained in diverse taxations matters. He has vast expertise in settling tax disputes with the Federal Tax Authority and handling of tax procedures in compliance with tax laws. He is adept in investigating underlying tax intricacies and offering expert tax advisory. He is also well-versed in conducting tax analysis’s and negotiations with the Tax Regulators, upon tax preparation and filing. Mostafa specializes in the areas of Tax law, Auditing, Accounting and Banking law.